I was wondering if anyone else has noticed this. As of Jan 1, the onus has changed on who is responsible for paying VAT on goods shipped to UK customers. The result is many companies no longer selling to UK customers. This is not about leaving the EU (the new rules apply to companies worldwide; it just happens to have come in on the same date).

The UK Government now expects foreign businesses to register with HMRC so that they pay the VAT instead of the purchaser on import to the UK. It's called 'Supply VAT' instead of 'Import VAT'. So guess what - lots of smaller companies (inside the EU and worldwide) are saying sod that - we won't sell to UK customers. Why on Earth would they? Imagine if they had to register with the tax offices of all the countries they sell to and then file quarterly returns! Of course for big companies (Amazon, eBay, etc) with a high volume of trade, it's worthwhile complying.

The rules apply to business they call 'Online Market Places' (OMP). To be classfied as n OMP, a company must do all three of

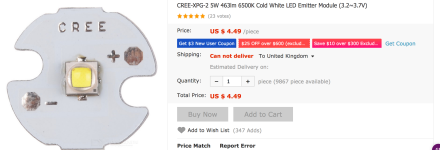

So that's pretty much any website selling goods then. The impact is most felt by many smaller websites such as those selling specialist parts e.g. electronics for caving, LED lamps. Companies no longer selling to UK customers include http://www.international.mtnelectronics.com/ (US based), www.leds.de (Germany) and www.dx.com (Hong Kong based I believe). The BBC had some headline about this the other week but it was written as if it's a consequence of Brexit, which it isn't as far I can tell - it's the result of a wider change in how the UK treats every online seller in the world. See https://www.bbc.co.uk/news/business-55530721

For me, it's mainly an annoyance as I like to play with building my own lights etc for fun but it's not my livelihood. I imagine for others it's a much bigger problem. Was this really the intended outcome of the law?

Anyway - I was wondering about other people's views, experiences and/or solutions.

Chris

The UK Government now expects foreign businesses to register with HMRC so that they pay the VAT instead of the purchaser on import to the UK. It's called 'Supply VAT' instead of 'Import VAT'. So guess what - lots of smaller companies (inside the EU and worldwide) are saying sod that - we won't sell to UK customers. Why on Earth would they? Imagine if they had to register with the tax offices of all the countries they sell to and then file quarterly returns! Of course for big companies (Amazon, eBay, etc) with a high volume of trade, it's worthwhile complying.

The rules apply to business they call 'Online Market Places' (OMP). To be classfied as n OMP, a company must do all three of

- in any way sets the terms and conditions on how goods are supplied to the customer

- is involved in any way in authorising or facilitating customers? payments

- is involved in the ordering or delivery of the good

So that's pretty much any website selling goods then. The impact is most felt by many smaller websites such as those selling specialist parts e.g. electronics for caving, LED lamps. Companies no longer selling to UK customers include http://www.international.mtnelectronics.com/ (US based), www.leds.de (Germany) and www.dx.com (Hong Kong based I believe). The BBC had some headline about this the other week but it was written as if it's a consequence of Brexit, which it isn't as far I can tell - it's the result of a wider change in how the UK treats every online seller in the world. See https://www.bbc.co.uk/news/business-55530721

For me, it's mainly an annoyance as I like to play with building my own lights etc for fun but it's not my livelihood. I imagine for others it's a much bigger problem. Was this really the intended outcome of the law?

Anyway - I was wondering about other people's views, experiences and/or solutions.

Chris