Mark

Well-known member

Just a heads up to anyone with a Co-op Bank account.

A company I deal with has a bank account with the Co-op, with around ?50K currently sitting there

They have received this statement from a colleague quite high up in financial circles

"From the Coop banks own website they report a Statutory loss before tax ?68.1 million for the first nine months of 2020

The July 2020 Fitch report, attached, estimated a ?Headroom? of ?243 million at the end of the first quarter - so lets say they now only have a headroom of ?200 million

Headroom means how much spare money have they got left to fall back on, before they do not comply with banking regulations and have to call for help or even hand control to the Bank of England.

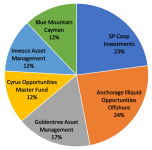

The rate of the Coop?s losses is clearly increasing with Covid-19 messing up just about everything, so its clear they only have a limited life expectancy -probably till about this time next year at best. Their only option is wait for a UK economic miracle or sell themselves to another bank or other institution. No other sane bank would buy a barrel of problems like this and so they must sell to some other buyer, for example an asset stripper. The current caretaker CEO of the Coop Bank has already begun talks with Dan Quayle?s Cerberus ?the three headed dog from Hades? and this has scared the Bank of England into invoking it?s powers to stop the sale. The Governor of the Bank of England will probably succeed in preventing Cerberus from buying the Coop Bank directly but maybe Goldman Sachs will let some other Great Lakes Yankee banker, who at least looks more respectable, have the Coop Bank. After 5:00 pm each evening Wall Street carries on trading and pulls tricks on European bankers as they drive home for their tea. Then the respectable ?Yank Bank? will sell to Cerberus and the Bank of England can do nothing about it.

After that, the Bank of England will have to cover lots of the lost deposits that sit under the UK Bank Deposit Guarantee Scheme. Other Junior Debt and deposits not underwritten will be subject to US Courts rulings and get settled at so much pence in the pound, or to be more accurate, cents in the dollar. Your funds would be in that category. Might take two years to get some part of it back".

He recommended the company moves their money from the co-op to another bank which they are about to do

Im not looking for a debate on banking ethics or the like, just a heads up to do with what you want

A company I deal with has a bank account with the Co-op, with around ?50K currently sitting there

They have received this statement from a colleague quite high up in financial circles

"From the Coop banks own website they report a Statutory loss before tax ?68.1 million for the first nine months of 2020

The July 2020 Fitch report, attached, estimated a ?Headroom? of ?243 million at the end of the first quarter - so lets say they now only have a headroom of ?200 million

Headroom means how much spare money have they got left to fall back on, before they do not comply with banking regulations and have to call for help or even hand control to the Bank of England.

The rate of the Coop?s losses is clearly increasing with Covid-19 messing up just about everything, so its clear they only have a limited life expectancy -probably till about this time next year at best. Their only option is wait for a UK economic miracle or sell themselves to another bank or other institution. No other sane bank would buy a barrel of problems like this and so they must sell to some other buyer, for example an asset stripper. The current caretaker CEO of the Coop Bank has already begun talks with Dan Quayle?s Cerberus ?the three headed dog from Hades? and this has scared the Bank of England into invoking it?s powers to stop the sale. The Governor of the Bank of England will probably succeed in preventing Cerberus from buying the Coop Bank directly but maybe Goldman Sachs will let some other Great Lakes Yankee banker, who at least looks more respectable, have the Coop Bank. After 5:00 pm each evening Wall Street carries on trading and pulls tricks on European bankers as they drive home for their tea. Then the respectable ?Yank Bank? will sell to Cerberus and the Bank of England can do nothing about it.

After that, the Bank of England will have to cover lots of the lost deposits that sit under the UK Bank Deposit Guarantee Scheme. Other Junior Debt and deposits not underwritten will be subject to US Courts rulings and get settled at so much pence in the pound, or to be more accurate, cents in the dollar. Your funds would be in that category. Might take two years to get some part of it back".

He recommended the company moves their money from the co-op to another bank which they are about to do

Im not looking for a debate on banking ethics or the like, just a heads up to do with what you want